In this commentary I would like to introduce the notion of contrarian investing within my magpie approach and whether it holds any attractions as an investment vehicle.

In 2020 Magpie 1, a strategy based on investing in those companies where my tracker group had increased their ownership by the largest percentage, delivered a return of 23.5% compared to the S&P500 Index’s rise of 16.3%. This continued a year on year winning streak stretching back over a decade. Magpie 1 is based on the notion that if you follow the investing activities of a group of well resourced institutional investors with my preferred by and hold approach to investing then you may come up with a list of ideas that have credibility and may outperform. You are buying the stocks because the best brains have come to the conclusion that these companies in Magpie 1 are likely to outperform. And that is what has happened.

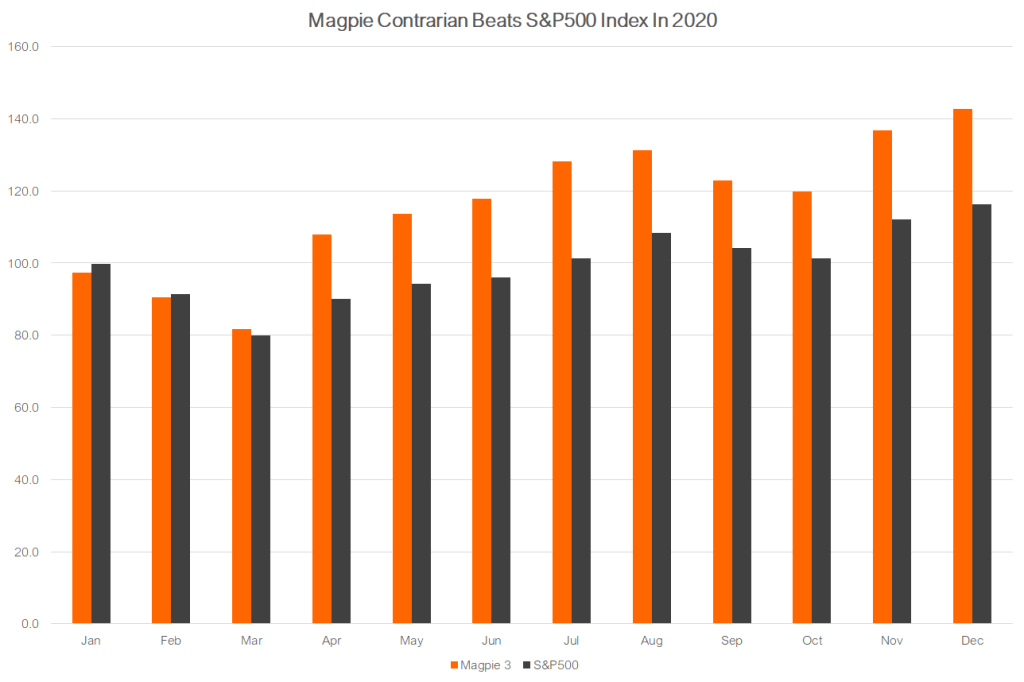

But I was also interested in whether the tracker group could just as easily get it wrong on a regular basis. This is where Magpie 3 comes in. It is the opposite of Magpie 1 in that it looks for those companies where the tracker group of institutional investors has been divesting in the year, reducing the percentage ownership by the most. So, while companies such as Western Union [WU], Zebra Technologies [ZBRA] and Abiomed [ABMD] made it into Magpie 1 in 2020 based on their having among the largest increases in ownership by my tracker group in 2019, so Chipotle [CMG], F5 Networks [FFIV] and Capri Holdings [CPRI] made it into Magpie 3 in 2020 on the basis of having seen the largest selling of their shares by my tracker group in 2019. The chart below shows how Magpie 3, comprising those 20 companies drawn from the S&P500 with the largest declines in ownership, performed as a portfolio.

As you can see the contrarian approach worked very well with Magpie 3 growing by 43% in the year compared to the 16% rise in the index. The performance was driven by excellent returns from the likes of Chipotle and F5 Networks, mentioned previously, and Lennar Corporation [LEN], Ameriprise [AMP], IQVIA Holdings [IQV] and Apache [APA]. On the downside, Capri, mentioned previously, was among a group including Allegion [ALLE] and Delta Air [DAL] that did not deliver and actually justified the negative stance taken by my tracker group. Indeed, of the 20 companies that formed Magpie 3 the division between out and under performing in 2020 was split evenly.

So, how did the outperformance come about? The 20 names that made up Magpie 3, if held for the year, would have delivered a 19.2% return, beating the market by a few points. The 43% return came about because of the 80% of book and sell rule that I have in place. If a company’s share price falls to a level 20% under the price I paid then that is a selling signal and I divest. Generally this is the right decision and companies do not necessarily recover within the year long investment horizon. Dentsply Sirona [XRAY] is a good illustration of this in that it crashed through the 80% floor in March before recovering to end the year down 6% on the start of the year and trailing the S&P500 by 22%. On the other hand, Eastman Chemical [EMN] was an illustration of where this defensive stance can work against you. It ran into trouble in February of 2020 and was divested from the portfolio but recovered to end the year well ahead of the index, up by 31%.

With everything that happened in March the decision was taken to sell as each company breached the 80% floor, sit on cash, and then reinvest at the beginning of April. This meant missing out on some of the bounce that occurred towards the end of March but also allowed for a more level headed approach to returning to the market, and with a 43% return for Magpie 3 it was clearly the right approach.

So, does this contrarian approach have any legs to it? It has beaten the index in 4 out of the last 6 years. While the S&P500 Index has returned 82% since the start of 2015 through to the end of 2020, Magpie 3 has delivered 127% in the same period, despite 2 underperforming years.

Looking to 2021 and the companies that were most heavily sold in 2020 – unsurprisingly – included considerable real estate exposure, so perhaps there is a recovery play in looking at Vornado [VNO], Federal Realty [FRT] and Equity Residential [EQT] which are in Magpie 3 for 2020. Western Union and Tapestry [TAP], which were both in Magpie 1 in 2020 are now in Magpie 3. Chipotle and Apache are still in Magpie 3, while Tesla [TSLA] is probably the most surprising entrant based on the selling activities of my tracker group.

I suppose the end conclusion of my delve into the contrarian thinking is that while I essentially back my tracker group of experts to guide me to good investment ideas these experts are just as likely to get it wrong big time. I am not interested in why they chose to sell these companies, just as I am not interested in why they buy the companies that form Magpie 1 each year. Suffice to say, betting with them and against them is proving to be a valid strategy. Something you might want to consider when looking at your own experts and what they are doing.

If this introduction to my contrarian search, or magpie investing in general, is of interest then do not hesitate to get in touch.